W2 payroll calculator

Use this tool to. File Online Print - 100 Free.

How To Calculate W2 Wages From Paystub Paystub Direct

File Online Print - 100 Free.

. How Payroll calculations are done. Employers and employees can use this calculator to work out how much PAYE. Calculate your Total W-2 Earnings After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other.

Salary Paycheck and Payroll Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. For example if an employee earns 1500.

Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Subtract 12900 for Married otherwise. Examples of payment frequencies include biweekly semi.

The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Heres a step-by-step guide to walk you through. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

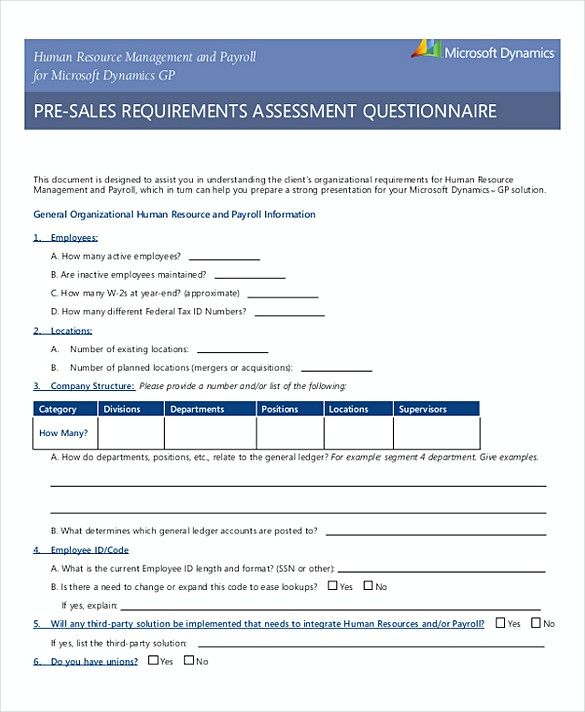

Timecard templates greatly minimize the need to closely monitor and record employee comings and goings. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. IRS tax forms.

It will confirm the deductions you include on your. Deductions from salary and wages. Ad 1 Use Our W-2 Calculator To Fill Out Form.

Get Trusted W-2 Forms - Fill Out And File - 100 Free. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Free Unbiased Reviews Top Picks.

Get A Fillable W-2 Form Tailored To Your Needs. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that. Ad Fill Out Fields Make an IRS W-2 Print File W-2 Instantly For Free.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. How It Works. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

Assuming the employee worked full time we could calculate back pay as follows. 2022 Federal income tax withholding calculation. Use our PAYE calculator to work out salary and wage deductions.

Ad Use Our W-2 Calculator To Fill Out Form. Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding. The employer is responsible for the payment of Tax Deducted at Source TDS for the salary that is paid to the employees whose annual salaries are above the maximum amount.

Ad Compare This Years Top 5 Free Payroll Software. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Access IRS Tax Templates Online.

Best of all data from timesheet templates can be easily imported into payroll. 15 per hour x 40 hours x 4 weeks 2400 per month 2400 per month x 8 months. Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free.

Ad 1 Use Our W-2 Calculator To Fill Out. Hourly Paycheck and Payroll Calculator Need help calculating paychecks. 2 File Online Print - 100 Free.

It is perfect for small business especially those new to. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Print File Instantly - 100 Free.

Ad Compare This Years Top 5 Free Payroll Software. Ad Edit Sign and Print IRS W-2 Tax Form on Any Device with USLegalForms. Skip To The Main Content.

Free Unbiased Reviews Top Picks. See how your refund take-home pay or tax due are affected by withholding amount. Calculating paychecks and need some help.

2 File Online Print - 100 Free. Estimate your federal income tax withholding. Gross Pay Calculator Plug in the amount of money youd like to take home.

Ad Use Our W-2 Calculator To Fill Out Form. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

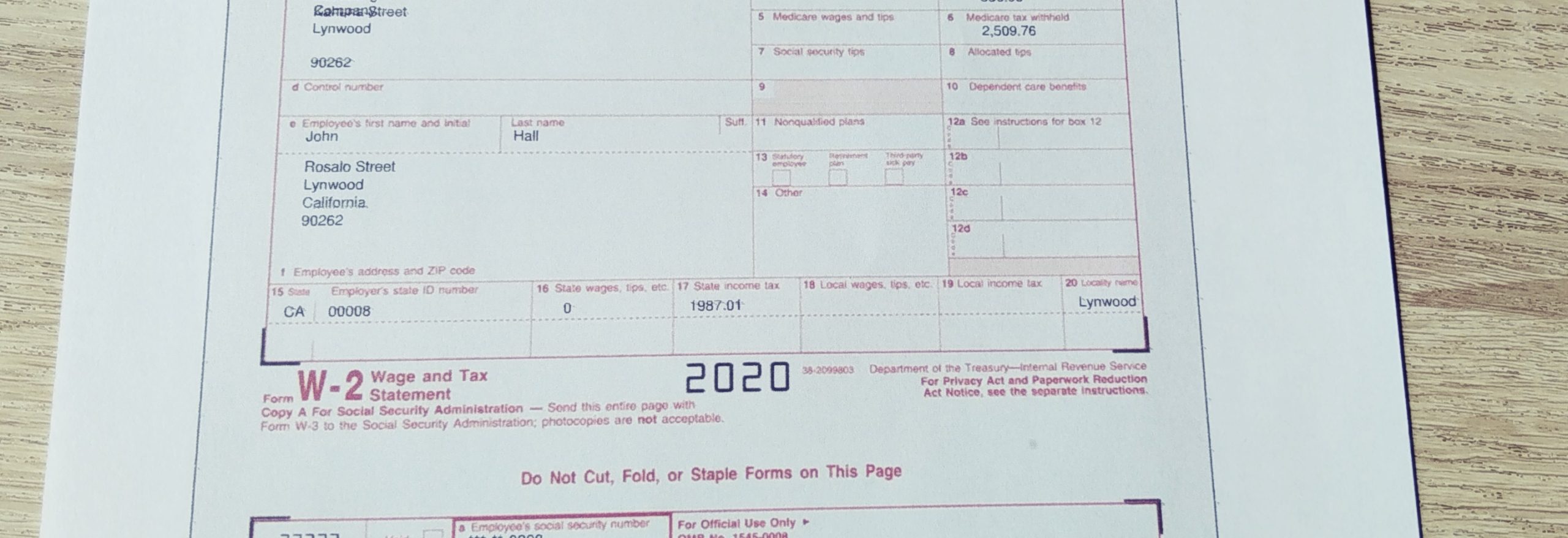

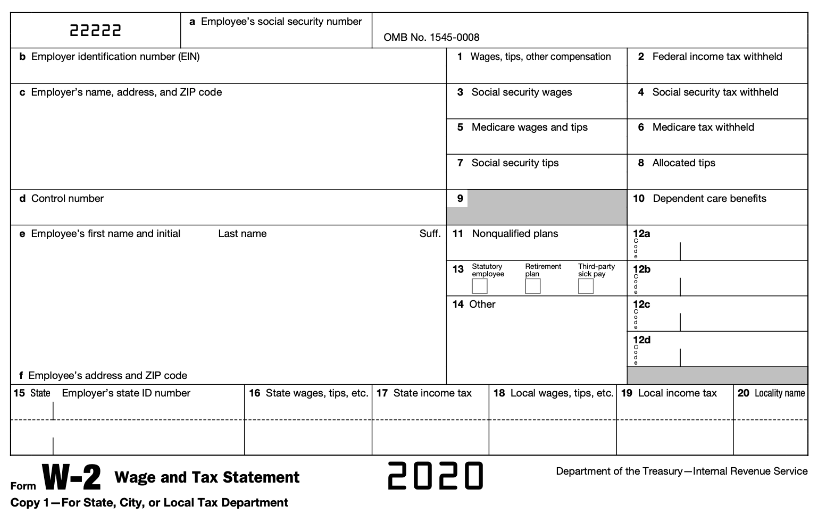

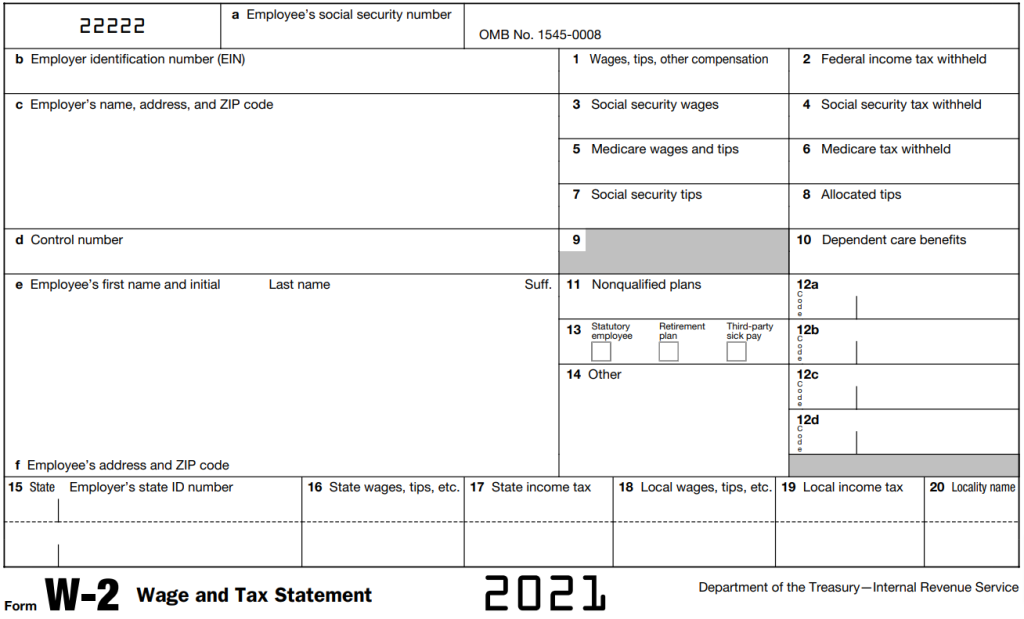

Understanding Your W 2 Controller S Office

Direct Deposit Pay Stub Template Free Download Word Template Template Printable Payroll Template

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

How To Calculate W2 Wages From Paystub Paystub Direct

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

What To Do If Your W 2 Or 1099 Is Stolen Tax Return Payroll Software Tax Preparation

Pin On Excel Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Payroll Checks Template Payroll Checks Payroll Payroll Template

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

W2 Online No 1 W2 Generator Thepaystubs

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

How To Read A Form W 2